Professional Financial & Tax Advisory Services

With over 85 years of combined experience, our team of five specialized partners provides comprehensive accounting, taxation, and advisory services tailored to your unique needs.

CA Associates

Established 1998

Our Professional Services

Tax Advisory & Compliance

Professional tax planning, compliance, and filing services for individuals and businesses, helping you navigate tax regulations efficiently.

- Income Tax Return Filing

- Tax Planning & Strategy

- GST Registration & Filing

Audit & Assurance

Thorough audit services conducted in accordance with applicable standards, providing reliable financial information and assurance.

- Statutory Audit

- Internal Audit & Controls

- Special Purpose Audits

Advisory Services

Strategic financial advice and business consulting to help you make informed decisions and improve your financial processes.

- Business Planning

- Financial Analysis

- Financial Risk Assessment

Our Leadership Team

Meet our team of experienced partners, each bringing deep domain expertise and industry knowledge to address your most complex financial challenges.

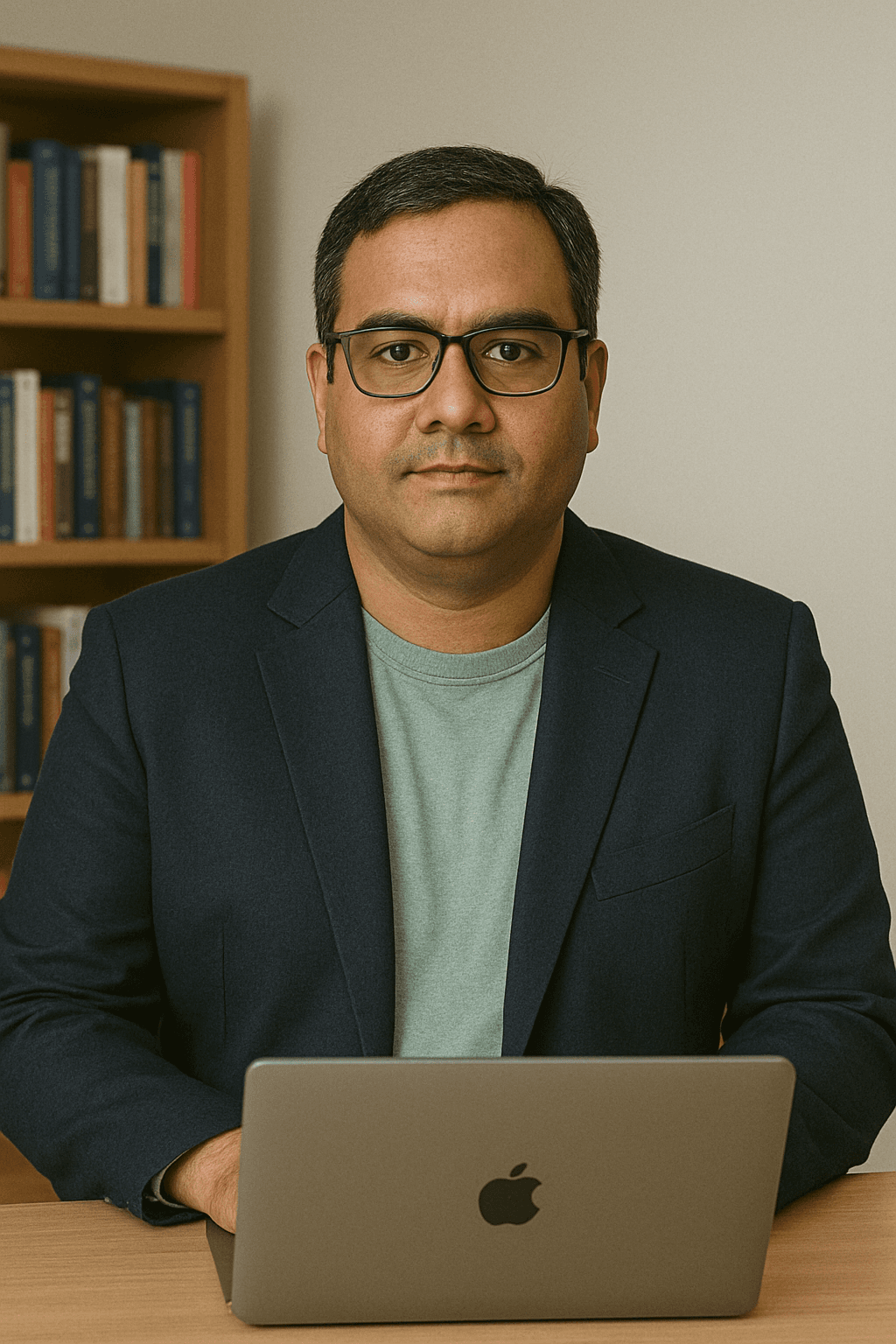

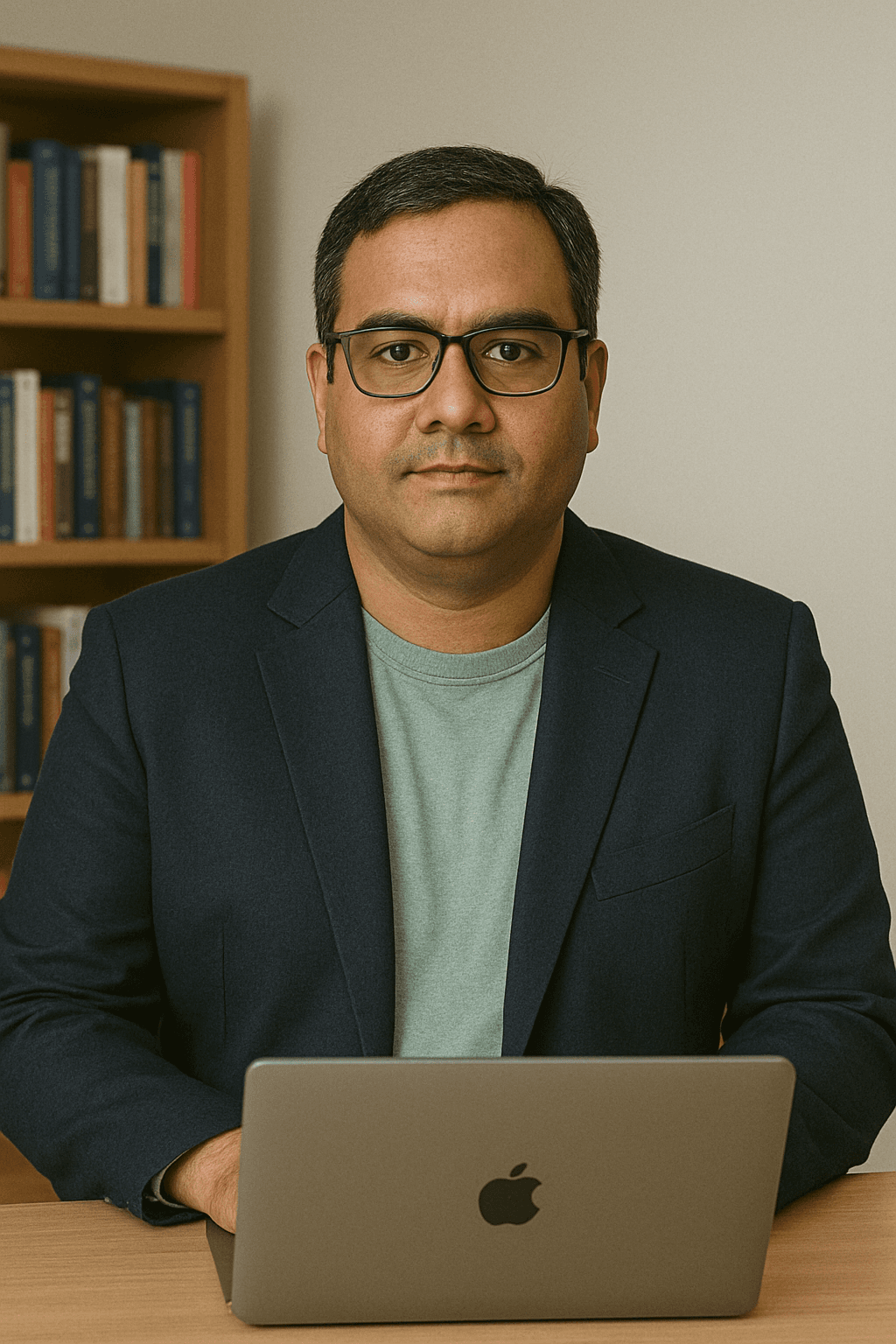

CA Rajesh Kumar

Senior Partner

Expertise: Direct Taxation

Experience: 25+ years

CA Priya Sharma

Managing Partner

Expertise: Audit & Assurance

Experience: 23+ years

CA Amit Patel

Partner

Expertise: Corporate Finance

Experience: 15+ years

CA Deepa Gupta

Partner

Expertise: Indirect Taxation

Experience: 14+ years

CA Vikram Singh

Partner

Expertise: International Taxation

Experience: 12+ years

Knowledge Resources

Access our curated collection of insights, guides, and tools designed to help you stay informed about financial matters and navigate regulatory complexities.

Latest Tax Updates

Updated: May 10, 2023

Our comprehensive analysis of recent changes in taxation laws and their implications for individuals and businesses, covering key updates in direct and indirect taxation.

Topics covered: Budget impact, tax rates, compliance changes

Read MoreGST Compliance Guide

Updated: April 15, 2023

A detailed guide to GST compliance requirements, including recent amendments, filing procedures, and best practices for businesses of all sizes.

Topics covered: Returns filing, input tax credit, e-invoicing

Read MoreFinancial Management

Updated: March 20, 2023

Practical strategies for businesses to maintain financial health during challenging economic periods and optimize operational efficiency.

Topics covered: Cash flow, cost optimization, financial controls

Read MoreReady to Get Started?

Schedule a consultation with one of our specialized partners to discuss your specific financial challenges. Our team is committed to delivering personalized solutions that drive your success.