Our Leadership Team

Meet our partners - a diverse team of experienced Chartered Accountants committed to providing exceptional service and expertise across specialized practice areas.

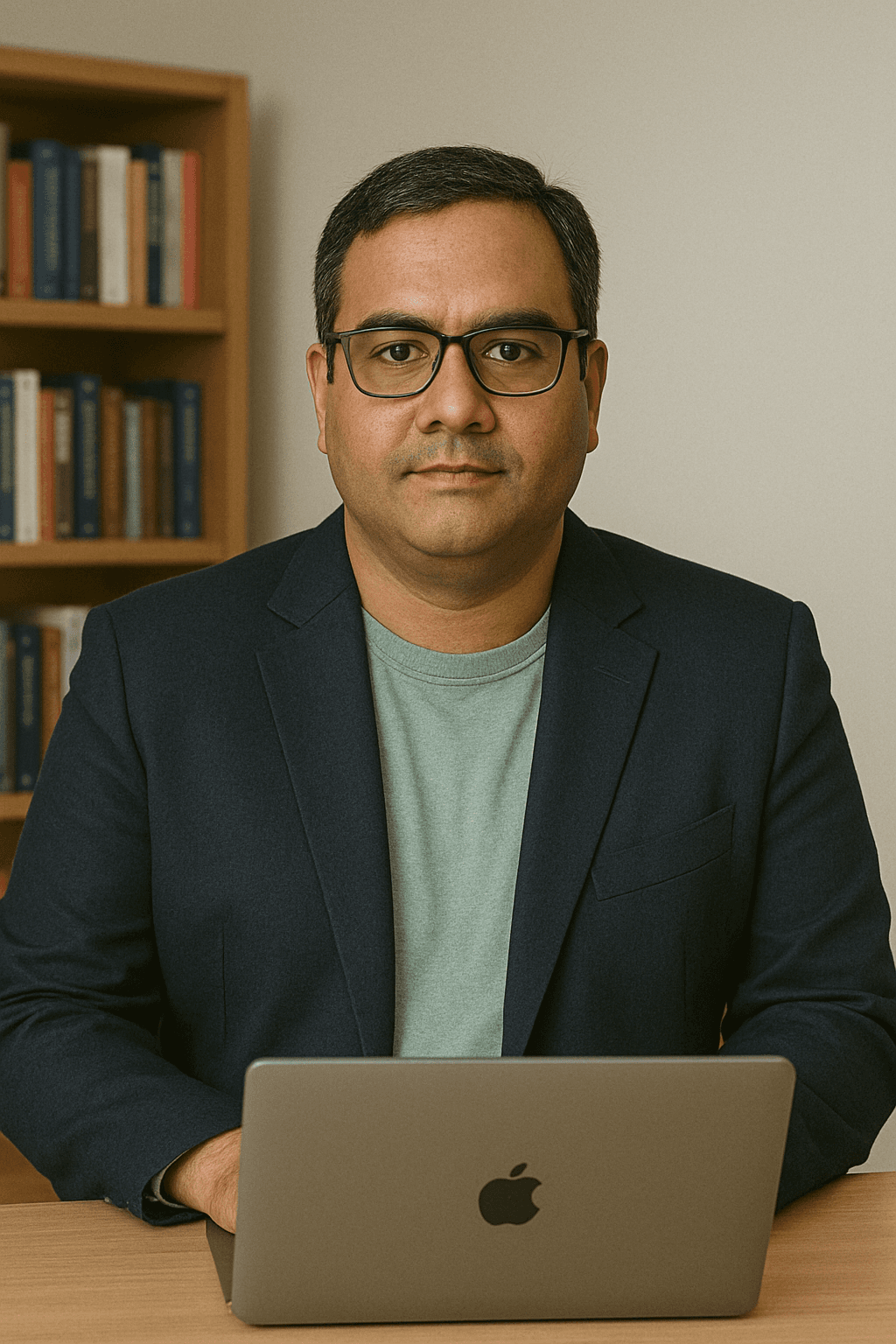

CA Rajesh Kumar

Senior Partner • Direct Taxation

Rajesh Kumar founded the firm in 1998 and has since built a reputation as one of the region's leading tax consultants. With over 25 years of experience, he specializes in direct taxation for corporations and high net worth individuals, with particular expertise in tax planning, assessments, and appeals. Rajesh is a frequent speaker at industry conferences and has authored numerous articles on tax strategy and compliance.

Education

- •Fellow Chartered Accountant (FCA)

- •Master of Commerce, Delhi University

- •Certified Financial Planner (CFP)

Key Achievements

- •Served on the ICAI Regional Council (2010-2013)

- •Author of 'Strategic Tax Planning for Growing Businesses'

- •Invited faculty at several management institutes

Professional Memberships

- •Institute of Chartered Accountants of India

- •Income Tax Bar Association

- •Chamber of Tax Consultants

CA Priya Sharma

Managing Partner • Audit & Assurance

Priya Sharma co-founded the firm alongside Rajesh Kumar and has been instrumental in developing our audit and assurance practice. She leads a team of professionals conducting statutory audits, internal audits, and special purpose engagements across diverse industry sectors. With her meticulous approach and deep industry knowledge, Priya helps clients strengthen their financial reporting and internal control frameworks.

Education

- •Fellow Chartered Accountant (FCA)

- •Bachelor of Commerce (Hons), Mumbai University

- •Certified Internal Auditor (CIA)

Key Achievements

- •Developed proprietary audit methodology for SMEs

- •Led over 500 statutory audits across various industries

- •Mentored over 50 CA students who have gone on to successful careers

Professional Memberships

- •Institute of Chartered Accountants of India

- •Institute of Internal Auditors

- •Women in Accounting & Finance Forum

CA Amit Patel

Partner • Corporate Finance

Amit Patel joined the firm in 2010 and was elevated to partner in 2015. He leads our corporate finance advisory practice, providing guidance on mergers and acquisitions, business valuations, fundraising, and financial restructuring. His dual qualification as a CA and MBA gives him a unique perspective on financial strategy and business optimization. Amit has facilitated numerous successful transactions and helped clients optimize their capital structures.

Education

- •Chartered Accountant (CA)

- •MBA (Finance), IIM Ahmedabad

- •Certified Valuation Analyst (CVA)

Key Achievements

- •Advised on transactions with cumulative value exceeding ₹500 crores

- •Developed innovative financial models for startup valuations

- •Guest lecturer at leading business schools

Professional Memberships

- •Institute of Chartered Accountants of India

- •Association of Investment Professionals

- •TiE (The Indus Entrepreneurs)

CA Deepa Gupta

Partner • Indirect Taxation

Deepa Gupta specializes in indirect taxation with particular focus on GST compliance, advisory, and litigation support. She joined the firm in 2012 and was promoted to partner in 2017. Deepa has guided numerous businesses through the complex transition to GST, helping them implement robust compliance systems and optimize their indirect tax positions. Her practical approach to resolving tax issues has saved clients significant costs and prevented compliance issues.

Education

- •Chartered Accountant (CA)

- •Bachelor of Commerce, Delhi University

- •Certified GST Professional

Key Achievements

- •Successfully represented clients in over 40 GST appeals

- •Developed comprehensive GST compliance framework adopted by 100+ businesses

- •Regular contributor to tax journals on indirect taxation matters

Professional Memberships

- •Institute of Chartered Accountants of India

- •Indirect Tax Professionals Association

- •GST Practitioners Association

CA Vikram Singh

Partner • International Taxation

Vikram Singh joined the partnership in 2019, bringing specialized expertise in cross-border taxation, transfer pricing, and international tax planning. He works with multinational corporations, exporters, and businesses with international operations to optimize their global tax positions while ensuring compliance with domestic and international tax regulations. His combined background in accounting and law enables him to provide comprehensive solutions to complex international tax challenges.

Education

- •Chartered Accountant (CA)

- •LLB (Tax Laws), Pune University

- •Diploma in International Taxation

Key Achievements

- •Structured international operations for 20+ Indian companies expanding globally

- •Resolved double taxation issues saving clients over ₹20 crores collectively

- •Developed transfer pricing policies for multinational groups

Professional Memberships

- •Institute of Chartered Accountants of India

- •International Fiscal Association

- •Bar Council of Maharashtra

Our Collaborative Approach

While each partner brings specialized expertise, we work together as a unified team to deliver integrated solutions

Multi-disciplinary Solutions

Complex financial challenges often require expertise from various domains. Our partners collaborate to provide comprehensive solutions.

Knowledge Sharing

We maintain a culture of continuous learning and knowledge exchange to ensure our entire team stays at the forefront of industry developments.

Peer Reviews

Our work undergoes thorough internal reviews by partners with complementary expertise to ensure the highest quality of advice.

Collective Decision Making

Major client strategies are developed collaboratively, drawing on the diverse perspectives of our leadership team.

All partners are members in good standing with the Institute of Chartered Accountants of India (ICAI) and adhere to its professional standards and code of ethics. The information presented on this page complies with ICAI guidelines for professional websites.